NEW YORK – Piedmont Lithium Limited (“Piedmont” or the “Company”) (Nasdaq:PLL; ASX:PLL) todayannounced that it plans to conduct a U.S. public offering, subject to market and other conditions, of 1.5 million of its American Depositary Shares (“ADSs”), with each ADS representing 100 of its ordinary shares (“Public Offering”).

J.P. Morgan, Evercore ISI and Canaccord Genuity are acting as joint book-runners and lead underwriters for the Public Offering. Piedmont intends to grant the underwriters a 30-day option to purchase up to 225,000 additional ADSs at the issue price of the Public Offering.

Proceeds from the offering will be used to continue development of the Company’s Piedmont Lithium Project, including definitive feasibility studies, testwork, permitting, further exploration drilling, mineral resource estimate updates and ongoing land consolidation, to fund the previously announced strategic investments in Sayona Mining Limited and Sayona Quebec Inc and other possible strategic initiatives, and for general corporate purposes.

The Public Offering is being made pursuant to an effective shelf registration statement that has been filed with the U.S. Securities and Exchange Commission (the “SEC”). A preliminary prospectus supplement related to the offering of the ADSs has been filed with the SEC and is available on the SEC’s website at http://www.sec.gov and on the ASX website. Copies of the preliminary prospectus supplement and the accompanying prospectus relating to the Public Offering may be obtained from J.P. Morgan Securities LLC, c/o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717, by telephone at (866) 803-9204 or by e-mail at prospectus-eq_fi@jpmchase.com; Evercore Group L.L.C., Attention: Equity Capital Markets, 55 East 52nd Street, 35th Floor, New York, NY 10055, by telephone at (888) 474-0200 or by e-mail at ecm.prospectus@evercore.com; and Canaccord Genuity LLC, 99 High Street, Suite 1200, Boston, Massachusetts 02110, Attention: Syndicate Department, by telephone at (671) 371-3900 or email at prospectus@cgf.com.

This press release is not an offer or sale of the securities in the United States or in any other jurisdiction where such offer or sale is prohibited, and such securities may not be offered or sold in the United States absent registration or an exemption from registration under the Securities Act of 1933, as amended.

Forward-Looking Statements

This press release contains “forward-looking statements” as defined by the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties. In some cases, you can identify forward-looking statements by terms such as “may,” “might,” “will,” “objective,” “intend,” “should,” “could,” “can,” “would,” “expect,” “believe,” “design,” “estimate,” “predict,” “potential,” “plan” or the negative of these terms and similar expressions intended to identify forward-looking statements. Piedmont cautions readers that forward-looking statements are based on management’s expectations and assumptions as of the date of this news release and are subject to certain risks and uncertainties that could cause actual results to differ materially, including, but not limited to, risks related to whether the Company will offer the ADSs or consummate the offering of the ADSs on the expected terms, or at all; the anticipated use of the net proceeds of the offering; the fact that the Company’s management will have broad discretion in the use of the proceeds from any sale of the ADSs; the Company’s operations being further disrupted by, or the Company’s financial results being adversely affected by public health threats, including the novel coronavirus pandemic; the Company’s limited operating history in the lithium industry; the Company’s status as an exploration stage company; the Company’s ability to identify lithium mineralization and achieve commercial lithium mining; mining, exploration and mine construction, if warranted, on the Company’s properties; the Company’s ability to achieve and maintain profitability and to develop positive cash flow from the Company’s mining activities; the Company’s ability to enter into and deliver product under supply agreements; investment risk and operational costs associated with the Company’s exploration activities; the Company’s ability to access capital and the financial markets; recruiting, training and maintaining employees; possible defects in title of the Company’s properties; potential conflicts of interest of the Company’s directors and officers; compliance with government regulations; the Company’s ability to acquire necessary mining licenses, permits or access rights; environmental liabilities and reclamation costs; volatility in lithium prices or demand for lithium; the Company’s ADS price and trading volume volatility; risks relating to the development of an active trading market for the ADSs; ADS holders not having certain shareholder rights; ADS holders not receiving certain distributions; and the Company’s status as a foreign private issuer, including the effects of our proposed redomiciliation from Australia to the United States on such status and subsequent status as a domestic issuer, and emerging growth company. Forward-looking statements reflect its analysis only on their stated date, and Piedmont undertakes no obligation to update or revise these statements except as may be required by law.

About Piedmont

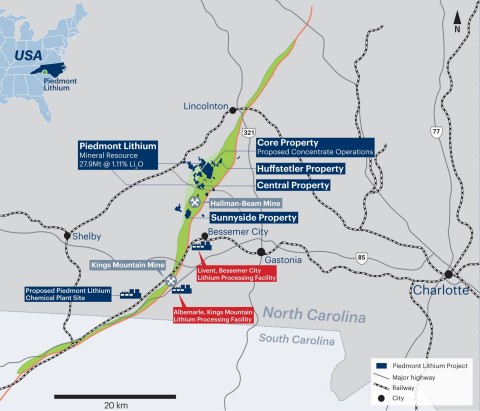

Piedmont Lithium (Nasdaq:PLL; ASX:PLL) is developing a world-class integrated lithium business in the United States, enabling the transition to a net-zero world and the creation of a clean energy economy in America. Our location in the renowned Carolina Tin Spodumene Belt of North Carolina, the cradle of the lithium industry, positions us to be one of the world’s lowest cost producers of lithium hydroxide, and the most strategically located to serve the fast-growing US electric vehicle supply chain. The unique geographic proximity of our resources, production operations and prospective customers places us on the path to be among the most sustainable producers of lithium hydroxide in the world and should allow Piedmont to play a pivotal role in supporting America’s move to the electrification of transportation and energy storage. For more information, visit www.piedmontlithium.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210322005762/en/

Keith Phillips

President & CEO

T: +1 973 809 0505

E: kphillips@piedmontlithium.com

Brian Risinger

VP – Investor Relations and Corporate Communications

T: +1 704 910 9688